Revolut Attracts Mortgage Innovator from Avant Money

Revolut has successfully lured a prominent executive from Avant Money, signaling the digital bank’s determination to capture a substantial portion of the market as it prepares to unveil its much-anticipated mortgage product next year.

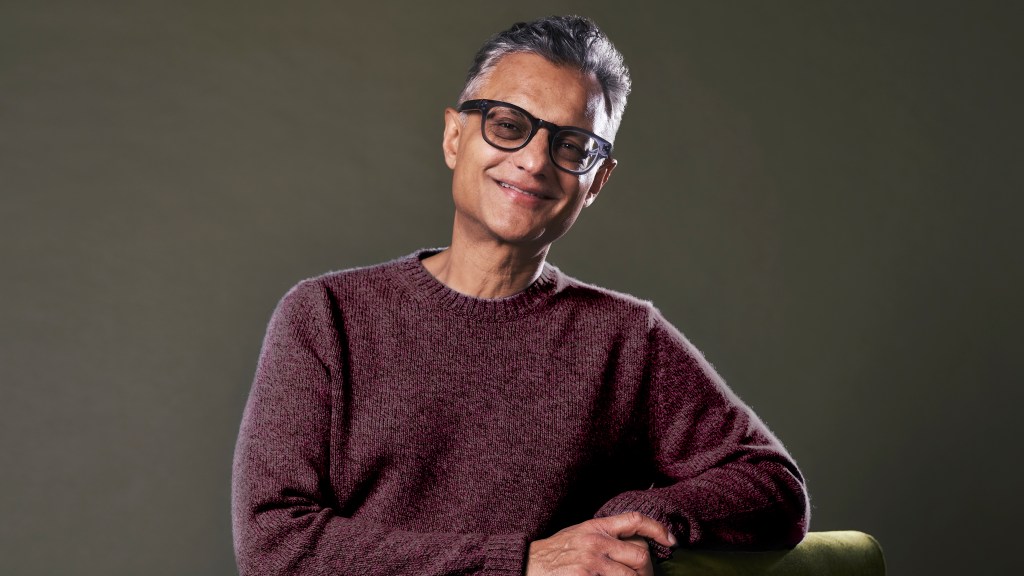

The fintech company, based in London, has appointed Stephen McCormick, who played a pivotal role in Avant’s effective commercial strategy in Ireland, to establish its mortgage team and expand its product offerings throughout Europe by 2025, according to insights from The Sunday Times.

This strategic hire is set to enhance Revolut’s Irish mortgage division, which the company has formed over the past six months in anticipation of introducing its inaugural home loans in Ireland in the second quarter of next year.

This move indicates a significant advancement in Revolut’s efforts to penetrate the traditionally retail bank-dominated mortgage market in both Europe and Ireland, particularly as players like AIB, Bank of Ireland, and PTSB currently lead the sector.

Market experts regard McCormick as an innovative figure in the mortgage landscape, recognized for his extensive experience and skill in creating successful challenger brands.

Having dedicated a lengthy period to Ulster Bank, McCormick has spent nearly four years with Avant. Alongside Brian Lande, the current head of mortgages who remains at Avant, McCormick helped propel Avant to the position of the leading non-bank home loan lender, achieving a notable 9 percent market share. Revolut will be keen to replicate this success. Since August, the company has been in discussions with mortgage brokers and other industry players, gearing up to launch its mortgage offerings through the Revolut app.

Insider sources indicate that the payment provider, claiming 2.7 million users in Ireland, will initially offer mortgages on a limited direct-to-borrower model before executing a broader rollout through broker networks.

However, some industry observers have raised concerns regarding Revolut’s ability to effectively address customer service requirements associated with mortgages, particularly given its digital-first approach and relative inexperience with complex financial products. For context, newcomer OUTsurance allowed itself a full year to refine its teams and processes before issuing its first insurance products.

Avant Money, which is part of the Spanish Bankinter group, entered the market with a pilot initiative in 2020 that involved only four brokers. Its broker network has since expanded to 50, which account for the majority of its home loans, while Avant itself employs approximately 100 staff members.

Despite losing plans for an Irish banking license, Revolut is authorized as a bank in Lithuania and could potentially adopt a similar approach when scaling its mortgage operations.

The allure of the Irish mortgage sector for new entrants is apparent, as nearly 80 percent of new mortgages are originated by AIB and Bank of Ireland. Meanwhile, non-bank lenders like Finance Ireland and Dilosk/ICS have faced challenges in gaining ground due to the elevated funding costs prevailing over the past two years.

Nonetheless, many new contenders in the last decade, excluding Avant, have struggled to significantly challenge the dominant position of the traditional banks, which benefit from a robust deposit base providing access to competitive funding and established customer relationships.

Post Comment